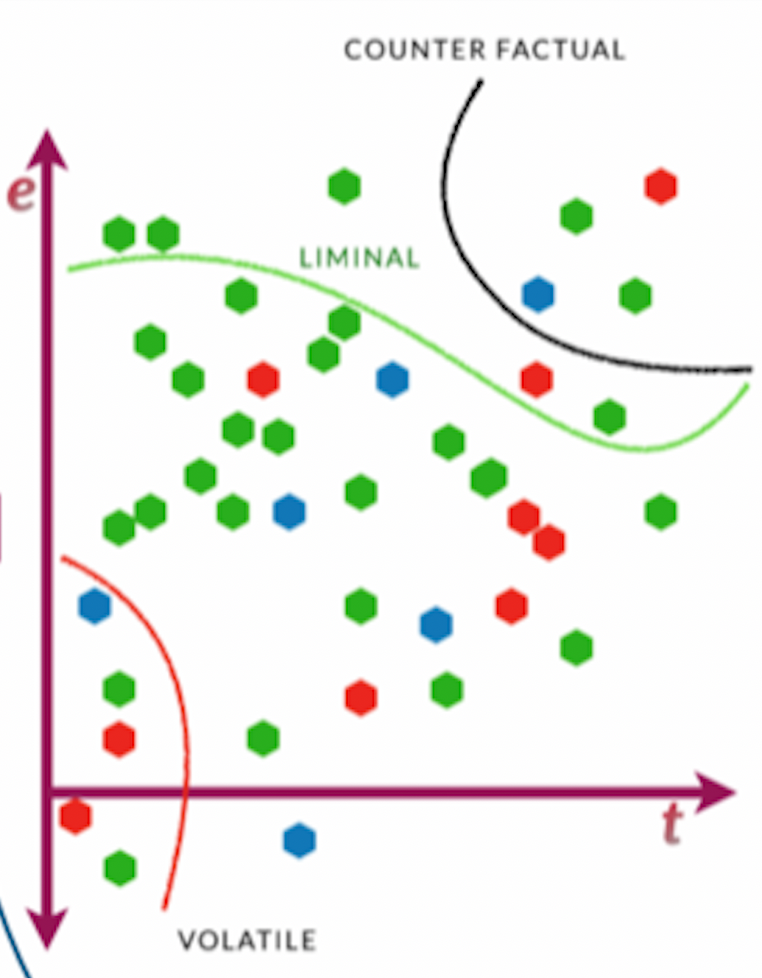

David Snowden recently gave a Complexity Lounge talk about the new Estuarine Framework. The Estuarine Framework is starting to incorporate real options, even if its creators are unaware of the fact. If we strip away the fluff and Stevian language, the meat of the framework is the presentation of options on a consultant’s two by two grid with a Y-Axis of “energy” and an X-Axis of “time”. We are told that “C” level leaders are more likely to engage with options that have low energy and time, and high energy and time options are “Counter-factuals” as they won’t happen. Below is a screen shot of the Estuary Map presented.

Any Real Options practitioner (there are no experts) would immediately realize that a third dimension is needed on the Map to represent level of uncertainty / volatility. We know that most people, and especially leaders, have a strong aversion to uncertainty. Without this uncertainty dimension, people may get lost in the swamp unsure why low energy, low time options are being ignored, and high energy, high time options are preferred.

Time in this model refers to one of the variants of lead time. It does not refer to timing which is one of the sweet spots of real options. Lead time is an operational metric, however from decision making perspective a risk metric such as duration (a.k.a. weighted lead time) is more useful.

An analysis of “energy” by a real option practitioner would reveal that its a “metaphor’, “euphemism” or “double entendre” for “cost” or “input”. What is needed in terms of input to make the change happen? The “metrics hierarchy” is a great way for practitioners to make sense of “cost” whether it is financial, social, environmental, energy of some form (e.g. Oil, Gas, Nervous) or even power exerted over a period of time. Each organization will have its own hierarchy that reflects its vision, values and culture. In academic terms, we would refer to the hierarchy as a context free “Typology of Costs”.

Decision making frameworks rarely involve just cost and time. Typically investments are compared using risk adjusted return on capital. Risk, Return and Capital (Cost) each have their own hierarchy to support sense making up and down, and across the organization. In context free academic terms, these would be a “Typology of Risk”, a “Typology of Return”, and a “Typology of Cost”. It is worth noting that lead time as expressed in the Estuarine Map is one example within the “Typology of Risk”, another significant one being uncertainty.

What is currently missing from the Estuarine Map is “Return”. Currently the map focuses on Energy (Cost) and time (Risk) when comparing options, however it does not incorporate “Return” or the value delivered by the change option. This is possibly because bad “C” Level leaders focus on “energy” ( cost ) which is something they can control rather than “Return” which is something that their customers normally control. We know from Clayton Christianson’s work that poor product designers give their customer’s what they want and ask for, and good product designers avoid the innovator’s dilemma and give their customer’s what they need, ultimately stealing them away from the poor product designers. As good product designers, we choose to include “Return”.

Once we have added “Return” to the Estuarine Map Framework, we can muse over which uncertainty or risk dominates. Is it the uncertainty of “energy” (Cost), “time” (Risk) or Return. In an academic context free world, there is a single answer. In the real (options) world, it depends on context.

Hopefully Estuarine Mapping will continue to develop into a useful decision making framework. As it does so, the value of real options will become better understood.

Leave a comment